ASC 605-50: Navigating Customer Payments and Incentives Compliance with Modern Accounting Tools

Posted In | ASC AccountingRevenue recognition can be a complex process, especially when dealing with customer payments and incentives. Accounting Standards Codification (ASC) 605-50, "Revenue Recognition – Customer Payments and Incentives," provides guidance on recognizing revenue in the context of these arrangements. In this article, we will explore how modern accounting tools can help businesses navigate compliance with ASC 605-50 and streamline the revenue recognition process.

What is ASC 605-50?

ASC 605-50 focuses on the treatment of customer payments and incentives in revenue recognition. These may include cash rebates, sales incentives, coupons, free products, or other promotional offers. ASC 605-50 provides guidelines on how to allocate the value of customer incentives and determine the impact on revenue recognition. Compliance with this standard is essential for accurate financial reporting and to avoid potential regulatory issues.

Modern Accounting Tools for Compliance

Modern accounting tools, such as specialized software and integrated systems, can simplify the process of complying with ASC 605-50. Here are some essential features to look for when choosing a modern accounting tool to help your business stay compliant:

1. Customizable revenue recognition rules

Choose an accounting tool that allows you to create customizable revenue recognition rules based on your specific needs. This will enable you to recognize revenue according to the terms of each customer incentive arrangement, ensuring accurate reporting and ASC 605-50 compliance.

2. Automation of allocation and recognition processes

Modern accounting tools should automate the allocation of the total incentive value and the subsequent recognition of revenue. This reduces the risk of human error and ensures timely and accurate revenue recognition.

3. Integration with other systems

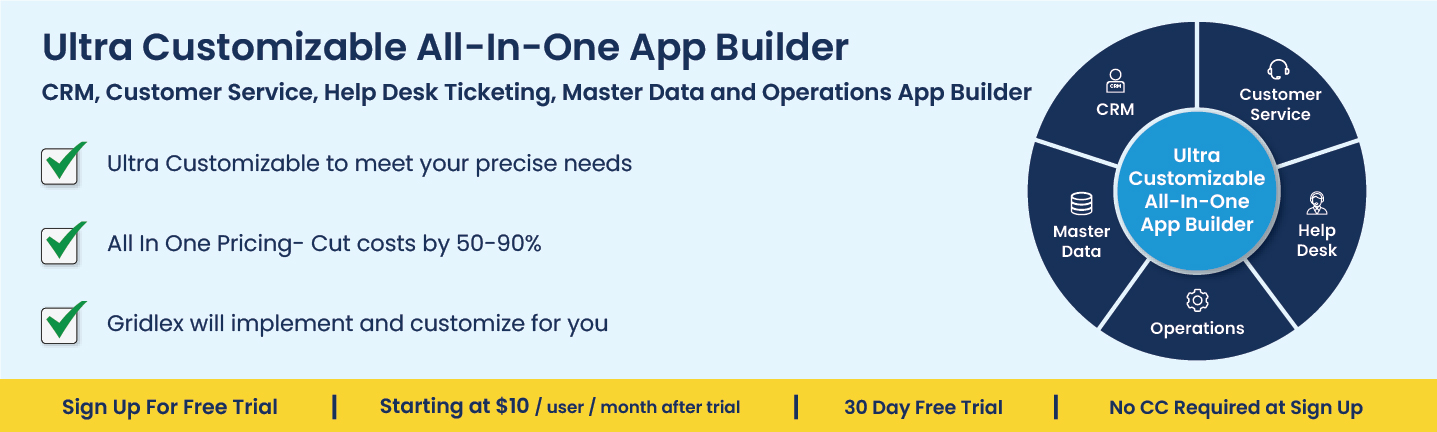

To ensure that all relevant information is considered when allocating and recognizing revenue, your accounting tool should integrate seamlessly with other systems, such as customer relationship management (CRM), enterprise resource planning (ERP), and billing systems. This ensures that data is accurate and up-to-date, reducing the risk of non-compliance.

4. Reporting capabilities

Your accounting tool should provide comprehensive reporting capabilities, allowing you to generate reports that demonstrate compliance with ASC 605-50. This can be especially helpful during audits and when addressing inquiries from regulators or other stakeholders.

5. Scalability

As your business grows and the complexity of your customer incentive arrangements increases, ensure that your accounting tool can scale with your business and accommodate an increasing number of arrangements and revenue streams.

Compliance with ASC 605-50 can be challenging, particularly for businesses with complex customer payment and incentive arrangements. By investing in modern accounting tools that simplify revenue recognition, automate key processes, and integrate with other systems, businesses can ensure accurate financial reporting and remain compliant with ASC 605-50. In today's competitive marketplace, leveraging advanced accounting tools is essential to help businesses effectively manage customer incentives and maintain financial transparency.